Protecting your identity online using anonymity

It seems like every week the newspapers are filled with horror stories of people’s identities being stolen, of millions of credit card numbers being stolen, of lives being ruined. People have been buying and selling goods and services literally since the dawn of humankind; so what has changed to cause this sudden massive increase in fraud? How are the purchasing habits of people today creating such opportunities for identity theft? What can we learn from the past to protect ourselves?

Identity Theft

Identity theft is when another person can take unauthorized actions that you become liable for. In modern societies, your identity consists of the documentation that uniquely identifies you. The scope of identity theft can vary from the ability to make unauthorized charges on your credit card, the ability to apply for unemployment, the ability to apply for new credit cards or loans, to the ability to apply for death benefits. The key issue is that making purchases today requires identifying yourself as part of the transaction. The act of identification allows for your information to be stolen and used for unauthorized purchases.

Money

So what is money anyway? It appears that money spontaneously arises in barter economies as society converges on a few key goods that meet the three requirements of money. Any object or token that can act as a store of value, a medium of exchange, and a unit of account may be used by a society as money. In addition to the three requirements, it is desirable that the object or token being used as money be difficult to counterfeit, be easily divisible, be easily transportable, be fungible, and be scarce.

So money is any object or token that people are willing to use to transact an exchange of goods and services. It is the people’s trust in the object or token and not some government’s mandate that determines its value. It all comes down to trust. Money has two forms of trust. Fiat money that is created by government entities for use under threat of force typically has minimal inherent value. The value of the object or token in relation to the goods and services being transferred is determined by the faith people have in the government to act in a rational and ethical manner. Since money must be scarce to have value, the ability for a government to print more money than the nations buying power or Gross Domestic Product (GDP) can support can and often does lead to inflation. Since inflation leads to the devaluation of the object or token representing money, fait money typically fails the requirement that it be a store of value which can be seen in the poor saving rate of the average American. Why own cash (savings) if its value diminishes in time?

If fait money depends on a rational government for its ability to act as a store of value then the only other alternative is commodity money. Commodity money is where the object or token of exchange has its own inherent value. Its value varies in relation to its perceived value verses the perceived value of the object being exchanged. Traditionally gold and silver have met the three requirements of an object to be used as money and have long been seen as a hedge against the vagaries of governments.

Anonymity

Being unknown. Being anonymous means keeping your identity hidden or protected. A strict definition of anonymity means that the parties of each transaction remain unknown to the point that it is impossible to know if two parties have had multiple transactions. An anonymous individual who walks in to a store and buys a pack of gum is only anonymous if there is no way to know if the individual has ever been in that store before. While preferable for some transactions for protection of the individuals involved most transactions prefer Pseudonymity or the use of a pseudonym. The use of a pseudonym allows an individual or an entire group to hide their real identity behind a single pseudonym. Pseudonymity allows for the creation of social networks that protect the true identity of individuals while still allowing for the pseudonym to gain trust through its interactions with others.

The purchase

Now that the basic principles behind identity theft and money have been explored, how does this relate to secure purchasing on the internet? The traditional business transaction since the dawn of humankind has been when two individuals come together in a buy sell arrangement and complete the transaction using a mutually trusted medium of exchange i.e. A person purchases a pack of gum from another person using money. The value of the gum in relation to the money is based on the trust the parties have in the money – not in each other. The purchase price is the relation of the worth of the gum to the perceived worth of the money. At no time does the identity of either party matter because the transaction is based on the perceived worth of the items being exchanged.

The flaw in Internet purchases that leads to identity theft is the fact that money isn’t used. Let’s repeat that. Money isn’t used to purchase products today – credit cards or debit cards are. Credit cards are a promise to pay later using money. Since the seller is only left with a promise of payment, who the buyer is matters. Can they pay? Who are they? Can they be found? Do they have a history of non-payment?

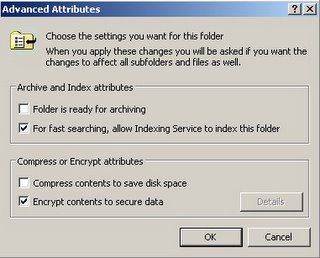

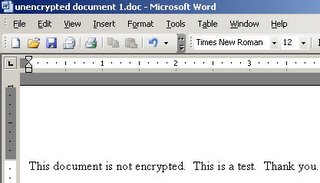

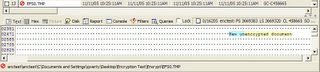

Solutions

Now that the root cause of identity theft has been highlighted, what are the solutions? Either a solution that allows for the creation of a pseudonym to limit identity exposure or a true electronic cash system allowing for anonymous transactions should be used.

A pseudonymous system would be one where the underlying transaction still requires the promise of payment but the trust issue is shifted from the buyer to a trusted third party. An example would be either a prepaid anonymous debit card or a single use credit card number. Either allow for some degree of protection.

A prepaid anonymous debit card becomes a bearer instrument where both parties trust is shifted and limited. The buyer limits exposure to theft and fraud buy determining how much money to entrust to the prepaid card and the seller has the trust in the buyer shifted to trust in the card providing institution.

A single use credit card number leverages an existing promise arrangement with a third party institution into a single transaction. The buyer requests a single use card number tied to an existing credit account for the purchase price of the goods from the seller. The card number is only good for a single transaction up to the requested amount. The buyer then provides the seller with all the information required plus the single use number. This allows the buyer to limit exposure to a predetermined amount. If the card number is stolen in transit the amount of loss is limited to a single one time loss of the requested amount.

While both of these systems – that are in use today – allow for the limited protection from identity theft by minimizing loss from existing credit lines, they don’t protect from the other forms of identity theft. Once enough personal information is disclosed it is possible for third parties to acquire new lines of credit in your name. The only solution is to limit the credit card transactions to trusted businesses.

A true electronic money system is one that meets the three requirements of money. Either the electronic object or token being used as money has a perceived inherent value such as commodity money or acts as fait money where the object or token is backed by a trusted entity. E-gold is an example of a commodity money system where the electronic tokens are backed by a commodity good – gold. The Octopus card is an example of a fait money system. Both systems work and allow anonymous transactions due to the fact that the transaction is base on the exchange of items of perceived equal worth.

"It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning."

- Henry Ford